Why These Discounts Matter

Many drivers pay more than necessary simply because they haven’t asked about every eligible credit. By uncovering overlooked savings, you can lower your premium without sacrificing coverage. Here are six discounts you may qualify for today.

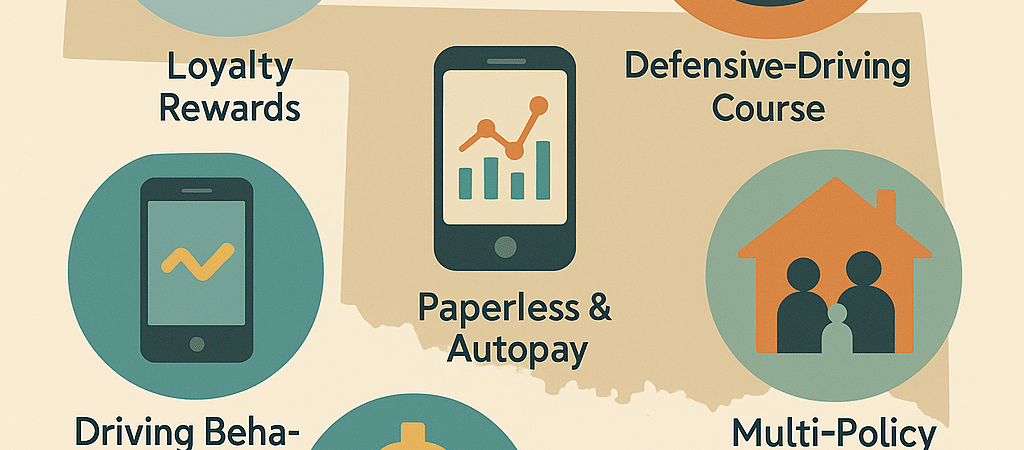

| Discount | How to Qualify |

|---|---|

| Loyalty Discounts | Maintain continuous coverage without claims; ask about multi-year credits |

| Defensive Driving Credit | Complete an approved defensive-driving course and provide certificate |

| Driving Behavior Tracking | Enroll in usage-based program; maintain safe driving metrics |

| Paperless & Autopay Discount | Switch to paperless billing and enroll in automatic payments |

| Upfront Pay Discount | Pay your full annual premium upfront at policy start |

| Multi-Policy Bundle | Bundle auto with home, renters, or life insurance for multi-policy discounts |

1. Loyalty Discounts

Carriers value long-term customers and often reward policyholders who maintain uninterrupted coverage. These rewards may come as percentage discounts applied at renewal or as special credits that accumulate over time. By demonstrating a history of claim-free tenure, drivers signal responsible behavior that insurers are eager to retain.

To qualify, simply keep your policy active with the same network of carriers. When it’s time to renew, request a breakdown of loyalty credits. Some providers offer tiered loyalty levels, where the discount percentage increases the longer you stay.

2. Defensive Driving Credit

Completing an approved defensive-driving program not only sharpens your skills but also lowers your risk profile in the eyes of insurers. Courses recognized by the Oklahoma Department of Public Safety typically qualify for discounts ranging from 5% to 15%, depending on the carrier.

Once you finish the course, submit your completion certificate to your agent or carrier portal. Timing is critical: ensure the course date falls within the eligibility window before renewal. Ask your agent for a list of state-approved programs and specific discount percentages.

3. Driving Behavior Tracking

Usage-based insurance programs leverage telematics—via a mobile app or in-car device—to monitor metrics like speed, braking, and mileage. Safe driving patterns can translate into discounts tailored to your real-world habits rather than demographic factors alone.

Enroll through your agent or the carrier’s website, then install the app or device. After a monitoring period (usually 3–6 months), review your driving report. Scores reflecting smooth braking, consistent speeds, and limited evening driving often unlock quarterly or annual savings.

4. Paperless & Autopay Discount

Going digital streamlines policy management and can earn you a small but steady discount. By opting for paperless billing and setting up automatic payments, you reduce administrative costs for your insurer—savings they often share with policyholders.

Enable both features online or ask your agent to add them to your account. Confirm that paperless preferences and autopay enrollments are active before your next renewal to capture the discount in your upcoming premium.

5. Upfront Pay Discount

aying your entire annual premium in one lump sum can yield an additional discount, often between 5% and 10%. This option cuts out installment fees and reduces billing overhead, making it cost-effective for drivers who have the budget for a single payment.

When reviewing quotes, request both monthly and upfront payment pricing. Compare the total cost of installments versus the single-payment rate to determine the best value for your finances.

6. Multi-Policy Bundle

Combining your auto policy with home, renters, or even life insurance under one provider unlocks notable multi-policy discounts—commonly 10% or more. Bundling also simplifies your billing and provides consistent service for all your coverage needs.

Discuss your existing policies with your agent. You may qualify for retroactive bundle savings if you transfer a policy into the same carrier network. Evaluate whether adding a home or renters plan balances overall savings against any cost differences.

Ready to Claim Your Savings?

Don’t leave money on the table. Fill out our one-page quote form to compare offers from multiple top-rated carriers—each tailored to reveal every discount you deserve.

https://oklahomainsurancetips.com/get-your-auto-insurance-quote-in-minutes/