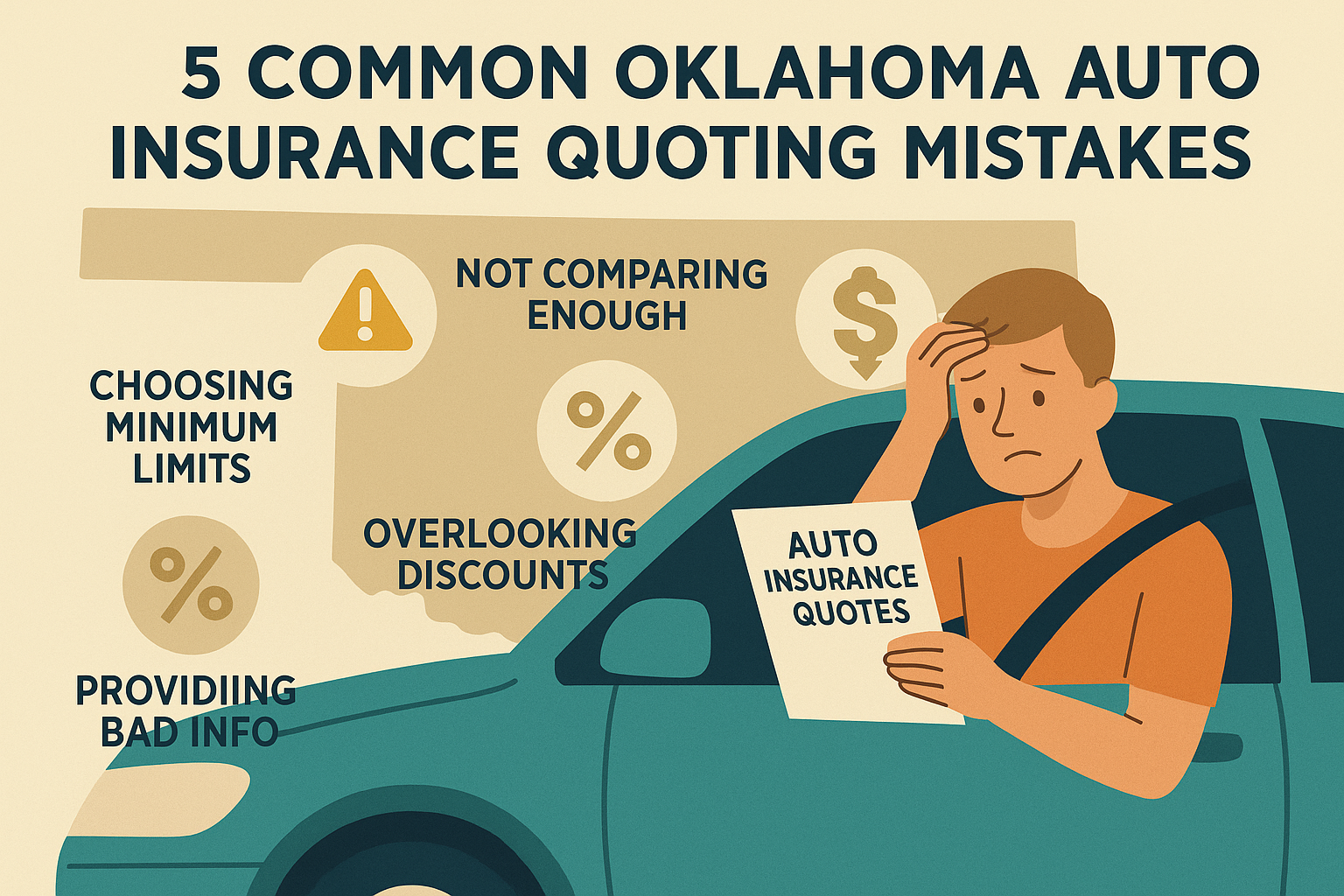

Avoid These 5 Essential Oklahoma Auto Insurance Quoting Mistakes

Shopping for coverage can be confusing. Steer clear of the most common Oklahoma Auto Insurance quoting mistakes—ensure you compare identical coverages, capture all discounts, and select the right limits.

| Mistake | Why It Matters |

|---|---|

| Inconsistent Information | Varying vehicle or driver details skew quote accuracy |

| Ignoring Coverage Differences | Comparing premiums without matching liability limits or deductibles |

| Overlooking Available Discounts | Missing credits like defensive-driving or multi-policy bundles |

| Not Verifying Financial Ratings | Choosing based solely on price risks poor claim handling |

| Forgetting Local Factors | Failing to account for Oklahoma-specific risks and territory |

1. Inconsistent Information

Providing different details—such as mileage, vehicle condition, or driver history—across multiple quote requests makes it impossible to compare offers honestly. Always use the same data for every insurer: accurate VINs, exact mileage readings, and consistent driver information.

Before you start quoting, gather all necessary documents: driver’s license numbers, vehicle registration, and current policy declarations. Consistency is the key to apples-to-apples comparisons.

2. Ignoring Coverage Differences

A low premium can look attractive until you realize the policy limits or deductibles don’t match your needs. Quotes with lower deductibles, higher liability limits, or extra coverages naturally cost more.

When reviewing quotes, align your liability limits (minimum 25/50/25 in Oklahoma or higher), collision and comprehensive deductibles, and any add-ons like roadside assistance. Only compare quotes with identical coverages to find the best value.

3. Overlooking Available Discounts

Many drivers assume the first quote reflects the best rate. In Oklahoma, carriers offer a range of credits—good student, defensive driving, loyalty, and multi-policy discounts—that can dramatically lower costs.

Ask each insurer or agent to apply every discount you qualify for. Keep documentation ready: defensive-driving certificates, vehicle safety feature proof, or proof of bundled policies. A proactive approach ensures you capture all eligible savings.

4. Not Verifying Financial Ratings

Price matters, but so does service reliability. A marginally higher premium from a carrier with an A+ A.M. Best rating can save you headaches when filing a claim, especially during Oklahoma’s frequent hailstorms.

Research carrier financial strength and complaint ratios via A.M. Best and the National Association of Insurance Commissioners (NAIC). Prioritize insurers with strong ratings and low complaint histories for a smoother claims experience.

5. Forgetting Local Factors

Oklahoma-specific risks—such as hail, tornadoes, and rural driving—affect policy pricing and coverage needs. Failing to account for these factors leads to unexpected costs after a loss.

When getting quotes, mention your ZIP code, typical driving routes, and parking conditions (garage vs. street). Ensure your policy includes adequate hail protection and considers local uninsured motorist rates.

Compare Quotes the Right Way

Ready to get accurate, comprehensive Oklahoma Auto Insurance quotes? Use our one-page form to compare personalized offers from top-rated carriers—ensuring identical coverages, applied discounts, and Oklahoma-specific factors for real apples-to-apples comparisons.

https://oklahomainsurancetips.com/get-your-auto-insurance-quote-in-minutes comparisons.